In this blog, we will discuss the fraudulent transfer of property. The concept of fraudulent transfer of property is incorporated under section 53 of TPA – Transfer of Property Act, 1882. We will elaborately explain rules laid down by section 53, essential factors constituting fraudulent transfer, who can sue under section 53, nature of suit, applicability and effects of section 53 and lastly the exceptions to section 53 with relevant case references.

Introduction

In simple words, fraudulent transfer of property denotes an illegal transfer of property with the malicious intent to defraud or delay the creditors. In case of fraudulent transfer of property, the debtor intentionally deprived the creditor from his lawful and just entitlements. Mostly, fraudulent transfer occurs in a debtor-creditor relationship. The rules regarding fraudulent transfer of property are recognized under section 53 of Transfer of Property Act, 1882.

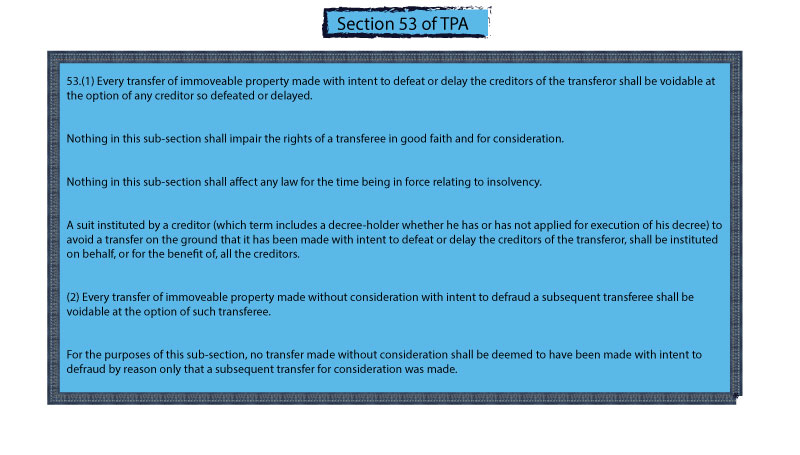

The Rules Laid Down by Section 53 of TPA, 1882

Section 53 of TPA, 1882 is comprised of two parts. The first part prescribes the principle that, where a transferor transfers his immovable property with the intention to defeat or delay his creditors, that transfer shall be voidable at the option of any creditor so defeated or delayed. Under section 53 of TPA, 1882 the right of a bona fide purchaser will be protected provided that he acted in good faith and he purchases that property for consideration in spite of the fact that the transfer was made by the seller with intent to defeat or delay the creditors.

The second part of section 53 of TPA, 1882 formulated the principle that, where a transfer of immovable property is made gratuitously or without consideration by the transferor with an intention to defraud the subsequent purchaser, such transfer shall be voidable at the option of such transferee.

The Purpose of Section 53 of TPA, 1882

The main objectives of section 53 of TPA, 1882 are –

- To shield the rights of a bona fide purchaser for value;

- To empower the creditors to avoid any transaction of immovable property made by the debtor/transferor with intent to defeat or delay the creditors;

- To make the assets of the transferor/debtor available to the general body of creditors

Essential Factors Constituting Fraudulent Transfer of Property Under Section 53 of TPA, 1882

- There should be a valid transfer of immovable property;

- The transfer should be a fraudulent transfer of property;

- The transfer should be made with the purpose or intention of defeating or delaying the creditors;

- The motive to defeat or delay the creditors must exist at the time of transfer made by the transferor.

- The suit under section 53 must be bought by the creditor in a representative capacity.

Analysis of Section 53 of TPA, 1882

Who can sue under section 53 of TPA, 1882?

A fraudulent transfer of property can be set aside by creditors only. The subsequent creditors as well as those creditors existing at the time of fraudulent transfer can sue under section 53 of TPA, 1882.

Who are creditors under the meaning of section 53 of TPA, 1882?

- A landlord is creditor in respect of rents due to him from tenant.

- A Hindu wife with a claim for past-maintenance against her husband is a creditor.

- A Muslim wife to whom dower debt is due is a creditor.

- An auction-purchaser, who is not a decree-holder cannot be a creditor but a decree holder who becomes auction-purchaser of the same property is a creditor.

Nature of the Suit Under section 53 of TPA

A creditor in order to avoid a fraudulent transfer of property must file the suit in a representative capacity. The benefit will be incurred in favor of all the creditors. Order 21, Rule 63 of CPC deals with the rules of representative suit.

Intention to defeat or delay the creditors

The intention and knowledge of the transferor are the gist of this section. Section 53 of TPA, 1882 prohibits transaction which removes property from the debtors for the benefit of the debtor. The debtor’s intention must be to benefit himself and to defeat or delay the creditors. Such intention can be proved by circumstantial evidences. From the following factors the court can infer that the transaction is not bona fide –

- Selling all the properties and keeping nothing to himself

- Inadequate Consideration

- Secret Transfer

- Putting all the properties out of the reach of the creditors

Good Faith and Consideration

The purchaser of the property from the transferor must prove firstly, that he had paid a fair and adequate price and secondly, that he was not a party to the fraud. He also has to prove that he acted in good faith. The standards of good faith are –

- There must be an honest dealing between the parties;

- The purpose of the transaction needs to be honest;

- There must exist faithful performance of duties;

- There must be an absence of fraudulent or malice intent.

The term consideration used under section 53 of TPA, 1882 has the same meaning as it has under The Contract Act, 1872. It excludes natural love and affection between the parties.

Defrauding Creditors

The debtor may prefer any creditor he chooses, to discharge the debt. But in doing so, debtor must not retain anything for his own benefit. A mere preference of one creditor to another is not fraudulent under this section. It will not amount to fraud, if debtor wants to shield some property from being proceeded against by creditors while there are other properties from which the dues of the creditors may be realized.

Applicability of Section 53 of TPA, 1882

The section applies in the following cases –

- Hindus and Mohammedans

- Voluntary remissions of debts

- Transfers of movable properties

- Transfer by operation of law

- Partition in joint family

- Surrender of widow’s interest by the widow

The Burden of Proof

Under section 53 of TPA, 1882 the burden of proving that a transfer is fraudulent lies on the creditors as he is attacking the debtor with this section. Once the fact is established by the creditor that the transfer was made fraudulently to defeat or delay his claims then the burden shifts on the transferee to prove that he acted in good faith and he is a bona fide purchaser for value and he was not a party to the fraud. So, the transferee can use this section as a shield for his defense and the creditor can use this section as a sword to attack the debtor.

Effects of Section 53 of TPA, 1882

A fraudulent transfer of property is voidable at the option of the creditors and if they not choose to avoid it, the transfer may be valid between the debtor and purchaser. Where a substantial portion of the transfer is fraudulent, the whole transfer shall be treated as fraudulent. Where only a part of the consideration was debt due to the creditor and the rest of it is fictitious the whole transfer must be void.

Exceptions to Section 53 of TPA, 1882

The section will not be applied in respect of following cases –

- Benami Transactions

- Preference of one creditor to over another

- Fictitious transfer of property

- Auction purchases

- Bankruptcy Laws

- Transfer on account of natural love and affection

- Sham Transaction

Case References

Karim Dad v Assistant Commissioner 1999 MLD 2371

If the whole transaction is based on fraud and misrepresentation then no valid title can be passed to the transferee by using a forged and fabricated deed.

Musahar Sahu v Lala Hakim Lal 1951 43 Cal. 521

It will not be fraud if the debtor chooses to pay one creditor and leave others unpaid provided that he must not retain any benefit.

Bangladesh v Serajul Haque 11 BLC 714

The defendants obtained an ex parte title decree collusively and by committing fraud. The court after discovering the truth set aside their transfer and declared it fraudulent.

Checkout our other Transfer of Property all articles here.

- What is Mens Rea and Actus Reus - February 13, 2024

- Case Summary of Anglo Norwegian Fisheries Case | United Kingdom V Norway - April 7, 2023

- What is a Solicitor? How to Become One - January 9, 2023