Introduction

There are total VII chapters in Transfer of Property Act, 1882. In chapter I which covers preliminary part from Section 1-Section 4, the main important part is Section 3. If we look at the definition of Section 3 of Transfer of Property Act, there are three important topics.

1.Movable and Immovable Property

2.Attested

3.Notice

Movable Property

The definition of movable property is not defined in Section 3 of Transfer of Property Act. In fact, it is not defined in any section of this act. It is defined in General Clauses Act, 1897 and Registration Act, 1908. According to these two act, something that is not immovable is movable property.

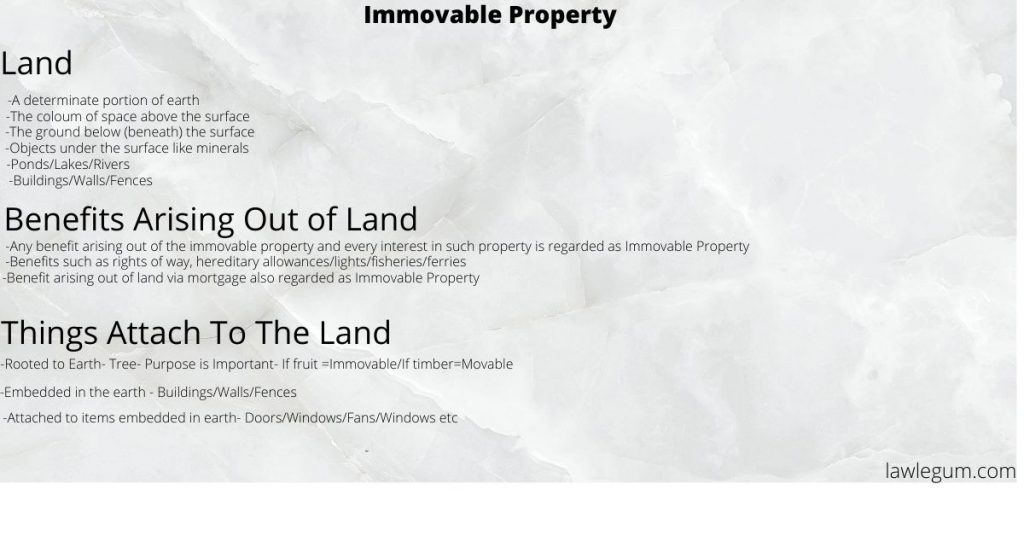

Immovable Property

Section 3 of Transfer of Property Act, defines with a negative definition of immovable property. It says, immovable property does include these three things.

1.Standing Timber

2.Growing Crops

3.Grass

It also says, building will be called as immovable property. Embedded machinery for beneficial use and the land used for that building will also be called as immovable property. These things are considered as immovable property- right to collect rent, right of way, a ferry, fishery, benefit arising out of land, things attached to the land a lease of land, etc.

Here are more details.

Case Laws

Shantabai V State Of Bombay

In this case, it was held that, the intention is important determining a tree whether it is movable or immovable. If the intention is use the tree for the purpose of enjoying fruits, then it will be regarded as immovable property. If the intention is to cut the trees and use it for industrial purpose or wood purpose, then it will be regarded as timber and timber is movable property according to Section 3 of transfer of property act.

Inox Air Products Ltd V Rathi Ispat Ltd

It was held in this case that things attached to earth or fastened to earth are immovable property.

Instrument

Instrument means legal document. Transfer of Property Act defined instrument only in two words that is “An instrument is a non-testamentary instrument’. Transfer of Property act won’t apply in testamentary instruments. It will apply only in non-testamentary instruments. Now what is testamentary and non-testamentary instrument?

Testamentary Instrument

In simple language testamentary means will. When an instrument takes effect after the death of the person making it, then it will be called testamentary instrument. As we all know, transfer of property act applies only on transaction or transfer between two living persons. That’s why it won’t apply in this act. Other places where this act won’t apply

- Inheritance

- Insolvency

- Forfeiture

- Sale of execution of decree

- By will

Non-testamentary Instrument

When transaction or transfer happens between two living person and there is no will then it will be called non-testamentary instrument. Transfer of Property act will apply in these

- Sale

- Mortgage

- Gift

- Exchange

- Charge

Attested

The literal meaning of attested is signing of a document or picture to emphasize that the person signed the particular document is a witness to the execution of the document. In simple language, it means to certify a document.

To understand it better you need to know the term ‘Animo Attestandi”. Animo attestandi means intention of attestation. It says, whoever is attesting witness, his intention should be in attestation.

Concept of Attested

Whenever a document is attested before that an execution happens. Suppose there are two parties and the parties signed that means they did the execution part. Here the parties will be called executant. The person witnesses the process and signed the document is called attesting witness and the whole process is called attestation. The final document is considered as attested.

Object of Attestation

The main object of attestation is to prove the authenticity and truthfulness of the execution. The main purpose of attestation is that there must be free consent i.e. there mustn’t be any force, fraud or undue influence.

Essentials of Attested

- Must have signed

- The attestation by two or more persons

- The sign must have been done in the presence of the executant.

Who can attest?

It’s very important to see whether a party has competency or not in attestation.

- A party can’t be an attester

- Interested party can’t be an attester

- Signing on behalf of an illiterate person is not attester

- If illiterate made mark by himself and the description is written by the scriber, then he is competent attesting witness. A scriber is the person who copies documents.

- Signature of the executant can be attested by an illiterate.

- A person with ‘Power of attorney’ can’t be an attestor as he is interested party.

Case Laws

Here are some of the famous case laws regarding Attested or Attestation.

1.ML Abdul Jabbar Sahib V Venkata Shastri

In this case, court held that if attesting witness has no intention or knowledge then the attestation won’t be considered as valid. It will be void. Animo Attentandi is important in attestation.

2.Kumar Harish Chandra Das V Bansidhar Mohanty

In this case, a moneylender gave some money to mortgagee and he gave the money to mortgagor. Here, moneylender was attesting witness and he became an interested party.

Here supreme court held that, interested party can also be an attesting witness. But in general, an interested party can’t be an attester. This is an exception.

3.Kundan Lal V Musrafa Rafi

In this case, Musrafa Rafi was the attester and she told that she couldn’t see the executant because of she was wearing Burkha. However, court held that, she could have seen if she had an intention.

Notice

Notice is the most important part of Section 3. That’s why we covered details about notice in another article. Click here to read the article.

Conclusion

Immovable property and Attested both are very important topic. We also tried to cover instrument in brief. Hope you now have an idea over Section 3 of transfer of property act. To grasp all, make sure to follow the Notice blog.

- What is Mens Rea and Actus Reus - February 13, 2024

- Case Summary of Anglo Norwegian Fisheries Case | United Kingdom V Norway - April 7, 2023

- What is a Solicitor? How to Become One - January 9, 2023